ROAD USER TAX: Why the Victorian EV and PHEV driving distance tax is BULLSHIT

The worst new vehicle tax in the world has been developed and implemented right here in Australia. Here’s 7 reasons the Zero Emission Vehicle Road User Charge is insane…

Nobody likes paying tax, but at least the majority of the public understands the basic concept of taxation is designed to help grow our society.

Tax pays for not only our roads and public transport, but education, our defence force, the building of our cities and infrastructure, our hospitals. But this latest political brainfart, taxing electric vehicles, is up there with the dumbest of them all.

Almost as dumb as the EV subsidies Victoria offered in addition to the tax.

There are no fewer than seven reasons that I can see for why the Victorian Zero and Low Emissions Vehicles Road User Charge is the most absurd new vehicle tax in the world.

The Road User Charge is a tax levied against EVs and plug-in hybrids because they allege these vehicles avoid paying the tax we know and love as fuel excise, currently at 47.7 cents per litre. If you burn liquid hydrocarbons in your car, that's what you pay.

If you avoid this tax by buying an EV, for example, you will pay 2.6 cents per kilometre because of this tax that you are avoiding, and slightly less if you buy a plug-in hybrid, but you will still be slugged for it.

How long before owners start finding a way to register their EV in another state?

The most affordable way to get yourself into an EV or PHEV is via a novated lease. A ‘green car’ priced under the Luxury Car Tax threshold will be free of fringe benefits tax. We can assist you with this process by simply filling in the form below and my team will get back to you ASAP.

Now, if this is your first time looking into electric vehicles and plug-in hybrids, you might like to first consider my EV Sanity Check to establish if actually owning one is going to be right for you.

And after that, I have an extensive list of every EV/PHEV in the market currently eligible for fringe benefits tax exemptions when you apply for a novated lease with your employer - it’s essentially a pre-tax payment you make on the acquisition and ownership of an EV or PHEV under the Luxury Car Tax threshold, instead of putting that money into government coffers.

ENQUIRE HERE

Here are my seven reasons why EV owners are getting a raw deal by Victoria’s RUC tax:

Seven: Pretty simply, fuel exercise is a federal tax, it's indexed bi-annually and it's going to keep going up in step with inflation. This Road User Charge is also indexed, as far as I’m aware, but it is a bespoke state tax. So tell me, Victorian government: exactly how does that work?

Six: There is no foreseeable reduction in liquid hydrocarbon fuel consumption or reduction in fuel excise revenue. It's just not happening and this rhetoric about EVs and their impact on things like fuel exercise is utter horseshit.

According to the Australian Automobile Association (AAA), fuel excise in 2013 - 2014 (so nine financial years ago) was $10.8 billion AUD. In this current financial year, the forecast is 13.9 billion. In the 2025 - 2026 financial year, so in two financial years’ time, it’ll reach $16.7 billion AUD.

Fuel exercise is not being impacted negatively by electric vehicles and plug-in hybrids - and it will not be impacted in the foreseeable future. We would need millions of EVs and PHEVs on the road to make a tangible difference to our liquid hydrocarbon drinking problem.

In fact, fuel consumption in Victoria was 7.9 billion litres in both 2016 and 2020, according to the survey of motor vehicle use which is an AusStats publication. There was a key difference in 2020 though, where 900 million fewer litres of petrol was consumed, and this was offset by 900 million litres of additional diesel consumption.

There is not a polar shift towards EVs despite the FCAI’s claims. What we're seeing is the market sprinting towards diesels such as light commercial vehicles, 4x4 wagons, large SUVs - things of this nature. Diesel is becoming far more popular in these vehicles, in fact in many vehicle ranges, such as SUVs - and I'm not talking ladder-frame 4WD-type SUVs - I'm just talking normal family SUVs. The diesel is the premium powertrain option because it's got the best equipment packaged with all-wheel drive.

It's priced more highly and people go to it because you get better fuel consumption and more mid-range power. So yes, there is an inflection point when it comes to zero and low emission vehicles, but the real movement in the market is towards diesel. Australia-wide, fuel consumption really hasn't changed from 31.4 billion litres in 2016 and 32.4 billion litres in 2020.

Australia worships diesel engines because they’re very good at their intended purpose.

Five: We're the only country in the world stupid enough to do this and by ‘country’ I mean Victoria specifically.

Some jurisdictions here are actively incentivizing EVs and their manufacturers. At a retail level, the obvious country to put up on a pedestal here is Norway and the reason there is that the government incentives like free parking, no tolls and things of this nature, really do motivate the population.

But the government incentives in particular make an e-Golf cheaper than a combustion Golf. If that were the case here, and if the vehicles were actually available (as in, in stock) then people would sprint towards EVs also. But we're not doing that.

Other markets are just waiting for the free market to do the right thing and start heavy lifting on EVs, and then the population will basically stampede toward them, or at least that is the notion out there, on the street.

But Victoria is the only jurisdiction in the world actively disincentivising EV adoption, despite plans to boost EV sales by 2030 >>. When you consider that 209 countries around the world and we're basically the only ones doing it, your somewhat obvious conclusion is that this is either a genius move that only Australia could pull off, or it's a bullshit move.

I am leaning pretty heavily towards bullshit, mainly because of…

Four: The reduction in tailpipe emissions.

See, toxic and carcinogenic emissions from combustion vehicles in our cities already kills more people prematurely than road trauma. This is just a medical fact which you don't have to like, but facts of course don't give a crap how you feel about them. Yay, facts.

Less toxic emission in our cities equals fewer people dying prematurely and that has to be a good thing for Victoria’s state-sponsored health system. Not to mention ‘good’ in the context of it being a moral obligation to get this job done.

Then there's the issue of national energy security, which is kind of important as well. See, Australia is preposterously vulnerable to upsets in the flow of liquid hydrocarbons from overseas, particularly as the stuff often comes from geopolitically unstable regions. Therefore, everybody who buys an EV or a plug-in hybrid is doing just a little bit for national energy security.

This tax is, of course, being sold by regulators to the population on the basis of fairness, like everybody doing their bit by paying their fair share to fund our roads. It's just emphatic, indefensible bullshit when you think about it in the broader context of fewer people dying prematurely and better energy security for the nation.

My AutoExpert AFFORDABLE ROADSIDE ASSISTANCE PACKAGE

If you’re sick of paying through the neck for roadside assistance I’ve teamed up with 24/7 to offer AutoExpert readers nationwide roadside assistance from just $69 annually, plus there’s NO JOINING FEE

Full details here >>

AutoExpert DISCOUNT OLIGHT TORCHES

These flashlights are awesome. I carry the Olight Warrior Mini 2 every day - it’s tiny, robust, and super useful in the field or in the workshop. Olight is a terrific supporter of AutoExpert.

Use the code AEJC to get a 12% discount >>

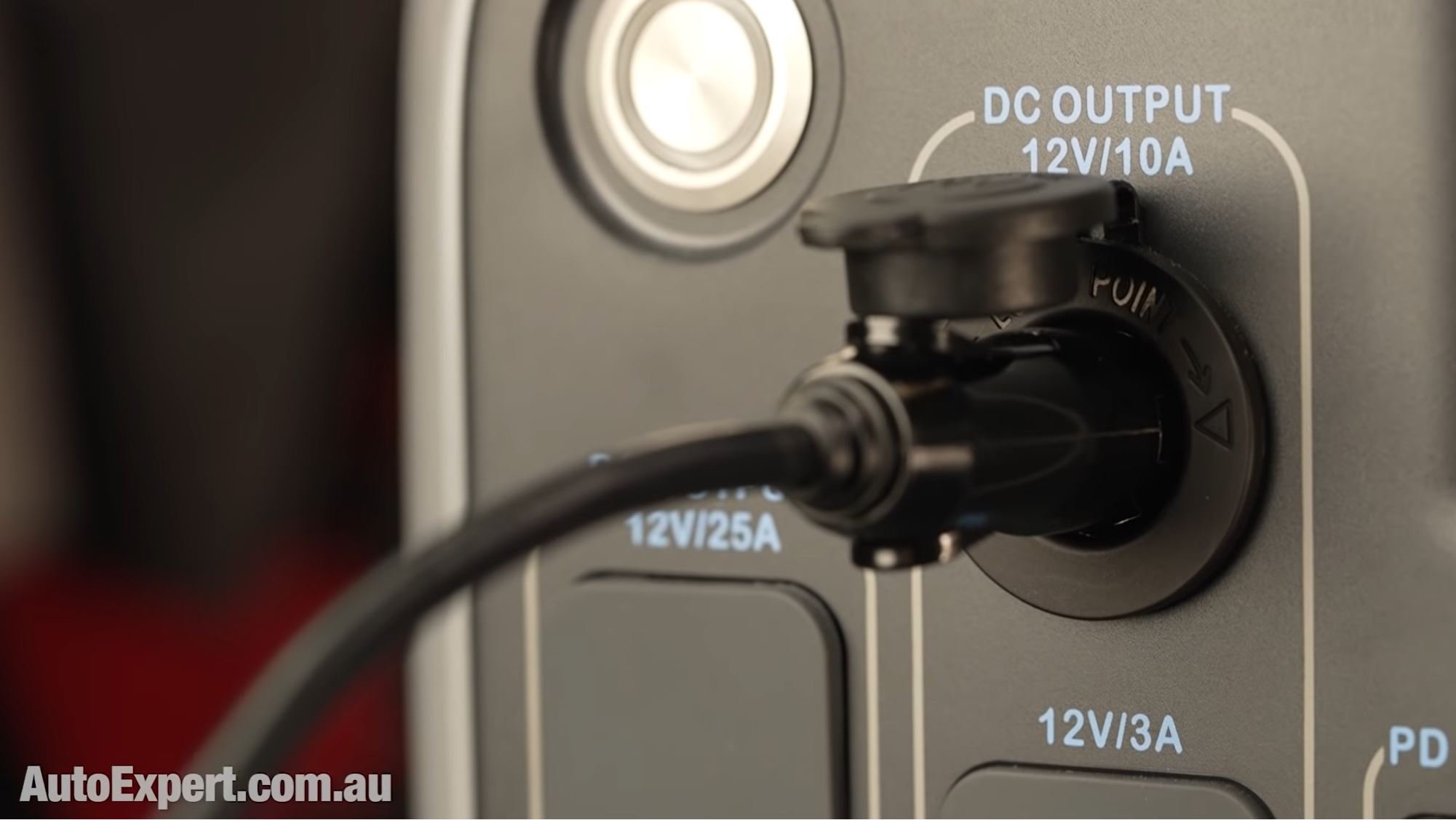

Generators suck! Go off-grid with AutoExpert BLUETTI PORTABLE POWER STATIONS

Need mobile, reliable power? If you’re camping, boating, caravanning or building a dirty big shed in the back paddock, and you need to run a refrigerator, lights, air conditioner, cooking, and/or a bunch of tools - Bluetti has a clean, tidy, robust solution…

Get your AutoExpert free shipping discount here: https://bit.ly/3n62heK

Three: EV owners already pay far more tax over the life of their vehicle ownership.

I'm going to run a bunch of numbers by you because they’re important. We're going to look at functionally equivalent cars because when you're a car buyer you look at vehicles in the context of whether the driving you intend to subject it to will be adequately met by that vehicle.

You shop based on whether a vehicle is big enough for your family, whether it will cover the distances you travel, if it can tow sufficient loads, whatever. If you decide that the options are for example a combustion Kona Highlander and an EV Kona Highlander; same body shell, same platform, same broad functional capability in our cities, but different powertrain - that's the choice for you to make.

If you're sitting on the fence, here's how this plays out in the domain of taxation:

The EV version in the Highlander spec is going to cost you AU$64,000 bucks plus on-road costs, and the combustion version $38,300. That's a substantial difference, but it's pretty typical if you can find a vehicle that's engineered for combustion and electric pwoertrains. The electric one is typically mid-20s higher in purchase cost just because batteries are expensive.

Therefore the EV owner is going to pay roughly $2640 dollars more GST and roughly $1000 more stamp duty in Victoria, which is I think 4.2 per cent, up to $70,000, roughly. The total upfront additional tax paid by the EV owner is $3640 in total, and we've all got to agree that that is not an insubstantial sum: you could have a nice weekend away for that much money.

That's actually equivalent to 8.2 years of fuel excise at current rates now, for the combustion-equivalent Kona; that’s making a few assumptions here, like doing city-based driving only, because if an EV is right for you that's probably the primary use that you're going to put it to.

Also, I've used the current 47.7 cents per liter fuel exercise, only the EV owner pays it up front, so if he drives out of the dealership and is crashed into by a truck, he/she has already paid that tax (and hasn’t even put any ‘wear and tear’ on the road). That's a pretty big win for the federal and state treasuries, I'd suggest. It's even worse than that, though.

It's not just 8.2 years of excise paid in advance, either. If you add up:

the ongoing burden of fuel exercise paid by the combustion owner

the additional tax paid up front by the EV owner,

the bullshit 2.6 cents Road User Charge

the additional GST

the additional stamp duty

and we predicate the whole comparison on city driving in Victoria with average kilometres per year (according to the Survey of Motor Vehicle Use)

and we use the urban consumption figure for the combustion Kona and 47 cents per litre for the (indexed) fuel exercise

and 2.6 cents per km for the (indexed) road user charge

If you do all of that, using a one-year snapshot to do this pretty reasonable comparison,have a guess where the break-even point on tax payable is.

The break-even point on tax is 24 years.

EV owners pay over the odds, and even more than big, thirsty emitters.

If you look at total tax payable, then the EV owner is behind financially; they pay more tax and only ever get to the point of equivalence, based on all of those data points that we put in, in 24 years.

It hardly seems fair, especially as both cars on the balance of probability are going to be dead well before that time is up. The EV owner is never going to be in front when you compare functionally equivalent vehicles.

The EV owner also probably invested, if that's the right word, in rooftop solar. Probably invested in a wallbox charger out the front of the garage, which is also additional tax for which there is no GST compensation. Plus, they’ve also helped keep electricians employed to fit said solar and charger boxes, while further reducing reliance on coal generated electricity.

Makes you wonder which vested interest wants to hold EVs back. Couldn’t possibly be Toyota, could it? Or the coal industry?

Two: Compliance with the Road User Charge is a joke.

If you own a car, are you not already well and truly burdened by compliance? You've got registration, compulsory third party and/or comprehensive insurance, there’s servicing and maintenance to keep it roadworthy - and now there's an additional burden upon you if you own an EV pr PHEV in Victoria.

As an EV/PHEV owner, you're required to substantiate the kilometres you've driven by taking a photograph of the odometer and you've got to submit it via an account with VicRoads or stand in line at a service centre. So good luck to all the aged pensioners who want to stop pumping filth int the air by dropping their retirement savings on an EV, but don’t have a smartphone or computer.

It's such a clunky fundamental process, and of course it's on you to remit the funds, and if you don't, your registration gets cancelled.

Also, ‘ZLEV operators’ - meaning EV/PHEV owners - are:

required by legislation to retain records of odometer declarations (including odometer photographs) and documents supporting exemption claims for five (5) years.

- VicRoads

The whole implementation of the tax is as clunky as anything an Australian government could contrive.

One: A complete contradiction.

If you're addicted to liquid hydrocarbons and you're a bolted on petrol head, imagine you've got an HSV Senator and you live in beautiful, leafy Richmond in Melbourne, and you drive to the CBD every day to your office. You're a fairly successful bogan, and it's not that long a drive, and you've always liked your Senator. But suddenly you look at those grandkids and you're developing a bit of a social conscience.

So you go from wanking chariot to a limp Toyota Prius. That’s 25 liters per 100km to to 3.4 - but let's call it 4L for the sake of an argument in the real world.

You're allowed to avoid, if that's the right word, paying the fuel excise on 21 of those 25 liters per hundred just by shifting to the limpdick Prius - and there's no penalty for doing that, you can avoid the fuel exercise any way you want in this way. Leave your car in the driveway and ride a personal mobility scooter or an e-bike, or just walk to the shops or move closer to work. Any of these things you’re free to do with zero penalty for any evaded fuel excise.

But if you just want to go the next step and completely eliminate those 4L of emissions and fuel excise, by going from the half-arsed Prius to zero emissions, then the Victorian government wants you to cough up.

This is what you're going to have to deal with now. They don't want you to move to an EV or a plug-in hybrid; they're fine if you avoid paying the fuel exercise by shifting to a more fuel-efficient combustion car or by just leaving the car at home. That's all good.

But the penalty is when you move to an EV or a PHEV. To me, this just seems preposterously out of step with all of the rhetoric and messaging we hear not just in Australia, but all over the planet in terms of environmental responsibility.

The soft-roading Subaru Forester packs a punch, and is one of the safest, most practical and capable SUVs on sale today. It’s also a great value, nicely driving and popular five-seater - with an all-new version coming soon…