Electric vehicle prices will soar. Here's why…

That EV you're lusting after is not going to get cheaper anytime soon. A bunch of mining industry insiders are in the position to offer some sobering facts. Brace for impact, EV nuts…

If you’re eagerly awaiting the cheap, fully-stocked electric vehicle revolution and production just ramping up to meet demand in the near future - sad news.

While Australia was distracted burying Her Royal Highness Queen Elizabeth II, there was a conference in Western Australia recently which didn’t spell optimism for electric vehicle affordability.

Benchmark Mineral Intelligence, an agency that I'd never heard of, was at the conference called Battery Gigafactories Asia Pacific on Wednesday September 28 (2022). Who knew?

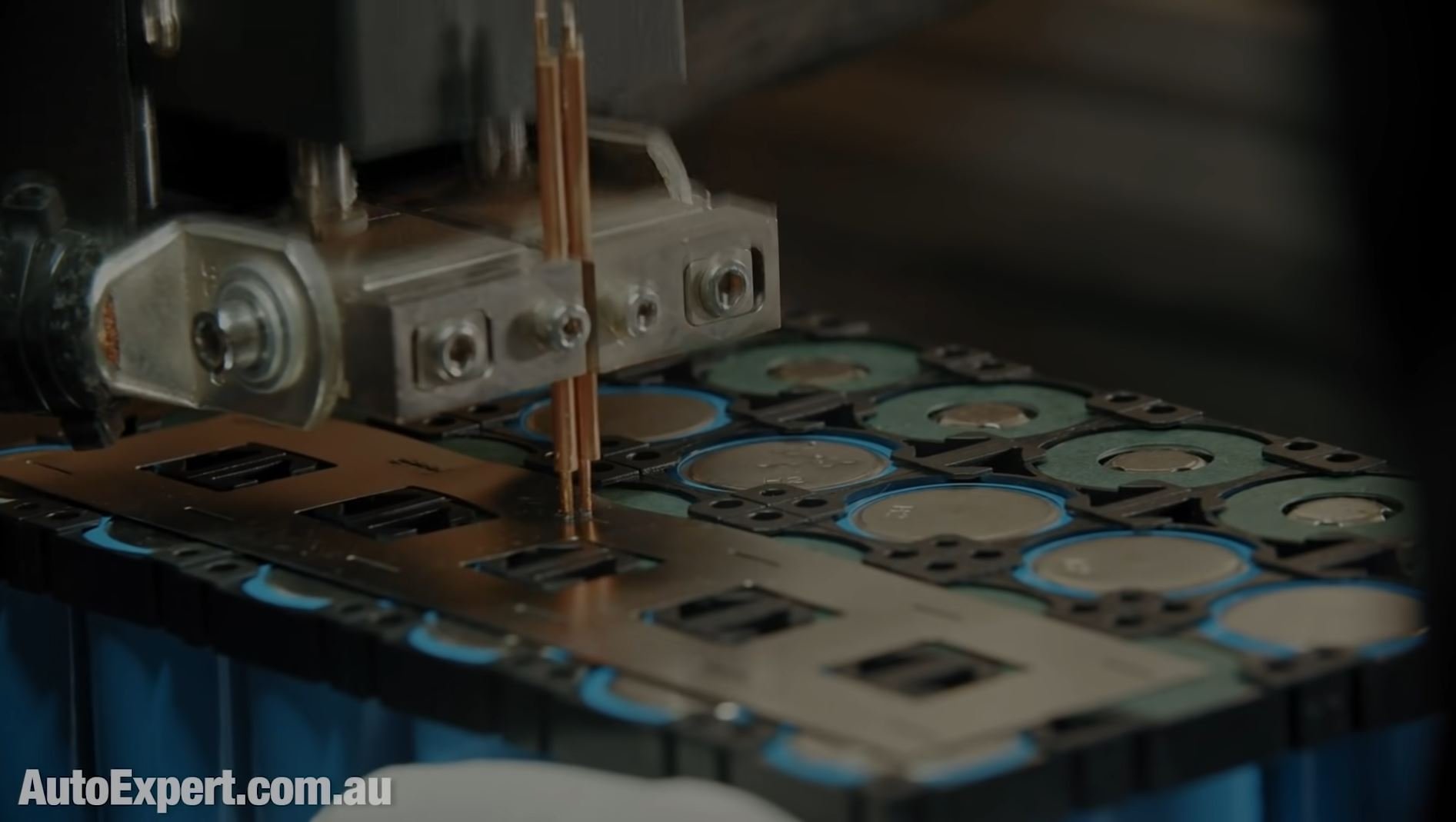

The salient message from all of it was that the spot price of all of the critical components inside batteries, such as lithium and nickel, have just spiked. Inconveniently.

Source: News.com.au

These are expensive things, all of a sudden. (Just like electric utes will be for rich people >>)

In China, the price of lithium hit US$70,000 per tonne, recently; nickel was $100K (USD) per tonne. This is just supply and demand operating.

At this conference, all of the bigwigs - some of whom were obviously economist types - didn’t seem to share the same one-eye optimism for affordable electric vehicles in the immediate future. Probably because they have strong data suggesting otherwise.

For transparency here, I don't have all that much respect for economists because their default proposition seems (at least to me) to be, ‘Well economics is like physics, only harder’. Obviously that’s bullshit because the salient difference is that, granted, economics is a kind of ontologically objective science, with rules, but the rules orbit money. Money is an epistemically subjective thing, at best.

In some respects, economics is a faith-based undertaking; it's not unlike religion in that respect.

With physics, however, if you jump off the sixth floor balcony, and you know the height, you can know exactly how hard you will hit the ground. Economics, not so much.

The joke is: economists are so good that they have accurately predicted nine out of the past five recessions.

Tells you everything you need to know about economists and economics.

Regardless, they have weighed-in, these leading mining economist bigwigs, with big titles, doing big jobs and they said some things which are really interesting in the context of how this is going to play for electric vehicles and their manufacture and supply thereof.

Will they meet demand? These people (and their respective companies and the industry of thousands as a whole), they all have a vested interest to get the job done. You should know this is the case because there's money on the table to do it.

Yet many of them seem to paint a picture in which this is, let's be kind, ambitious at best.

My AutoExpert AFFORDABLE ROADSIDE ASSISTANCE PACKAGE

If you’re sick of paying through the neck for roadside assistance I’ve teamed up with 24/7 to offer AutoExpert readers nationwide roadside assistance from just $69 annually, plus there’s NO JOINING FEE

Full details here >>

AutoExpert DISCOUNT OLIGHT TORCHES

These flashlights are awesome. I carry the Olight Warrior Mini 2 every day - it’s tiny, robust, and super useful in the field or in the workshop. Olight is a terrific supporter of AutoExpert.

Use the code AEJC to get a 12% discount >>

Generators suck! Go off-grid with AutoExpert BLUETTI PORTABLE POWER STATIONS

Need mobile, reliable power? If you’re camping, boating, caravanning or building a dirty big shed in the back paddock, and you need to run a refrigerator, lights, air conditioner, cooking, and/or a bunch of tools - Bluetti has a clean, tidy, robust solution…

Get your AutoExpert free shipping discount here: https://bit.ly/3n62heK

DIRE STRAITS FOR VESTED INTERESTS

Andrew Miller, who is the CEO (Chief Operating Officer) of Benchmark Mineral Intelligence said:

I think people have to treat these (elevated prices) as a warning sign of what's still to come for the market and for the various aspects of the supply chain over the years to come…

Let's not forget mining projects are not the sort of thing you can just turn on like the light. There has to be an approvals process and you've got to get it all underway, which generally takes years - particularly for any sort of exploitation that's potentially on the horizon. There's a lot of controls that have to be ticked off.

Miller continues:

This year alone we're expecting the global demand for lithium-ion batteries to grow by about 14 per cent and if you contrast the market where it was last year at around 450 gigawatt hours, we expect that by the early 2030s that number will top 3 000 gigawatt hours, so three terawatt hours of demand, in the pipeline in a relatively short time frame

Now, this is obviously more than a six-fold increase in demand in the timeframe of now to 10 years henceforth. This industry is groaning under the weight of trying to cope with that and capitalise on it now. There's no incentive for not capitalising on it.

Clearly carmakers cannot build enough EVs at the moment.

The question is, can they do it.

Sinead Kaufman, who is the lithium boss of Rio Tinto, said:

Battery materials in Rio has really been dedicated to trying to build at scale a portfolio of mining assets across lithium, but also other critical minerals and battery materials.

We see, as others do, an enormous demand for lithium as a building stock for lithium-ion batteries.

The Academy Award for stating the obvious goes to…

Ms Kaufman continued:

Forecasts show that light electric vehicles will make up 50 per cent of light vehicles on the road by 2030, which means that lithium consumption needs to surge way above anything that's currently been planned to be mined.

So these things aren't even in the planning stages yet but the forecast of elevated demand is in the pipeline.

Let's face it, we're only eight years away and in the context of setting up a full-on mining operation extracting thousands of tonnes of the target mineral, that's a photo finish. In the industry, that’s probably what they’d describe as a ‘less than ideal’.

Ms Kaufman, apparently, felt the point wasn’t quite driven home, so here it is for all the EV nuts out there who still feel optimistic about reaching affordable electric vehicle utopia in the next few years:

With every project in the world that's projected to come on we'll still be short by 50 per cent of the amount of lithium that's required to build the electric vehicles.

This is like economics 1-0-1. If there's an imbalance of supply and demand of that nature, the price of the single biggest and most expensive component of an electric vehicle - the battery - can only head in one direction. That's what's going to happen for the next eight years, according to people running companies directly seeking to profit from the increased demand.

Watch the full report for more details on why the future of electric vehicles will remain an expensive prospect for Australian consumers.

If you want one of the best driving, most luxurious and surprisingly capable five-seat SUVs in the market, don’t shop with the elite rip-off brands…